On Dec. 13, 2018, Andreas Binder gave a guest lecture on PRIIPs at the Bergische Universität Wuppertal “The Mathematics of PRIIPs”.

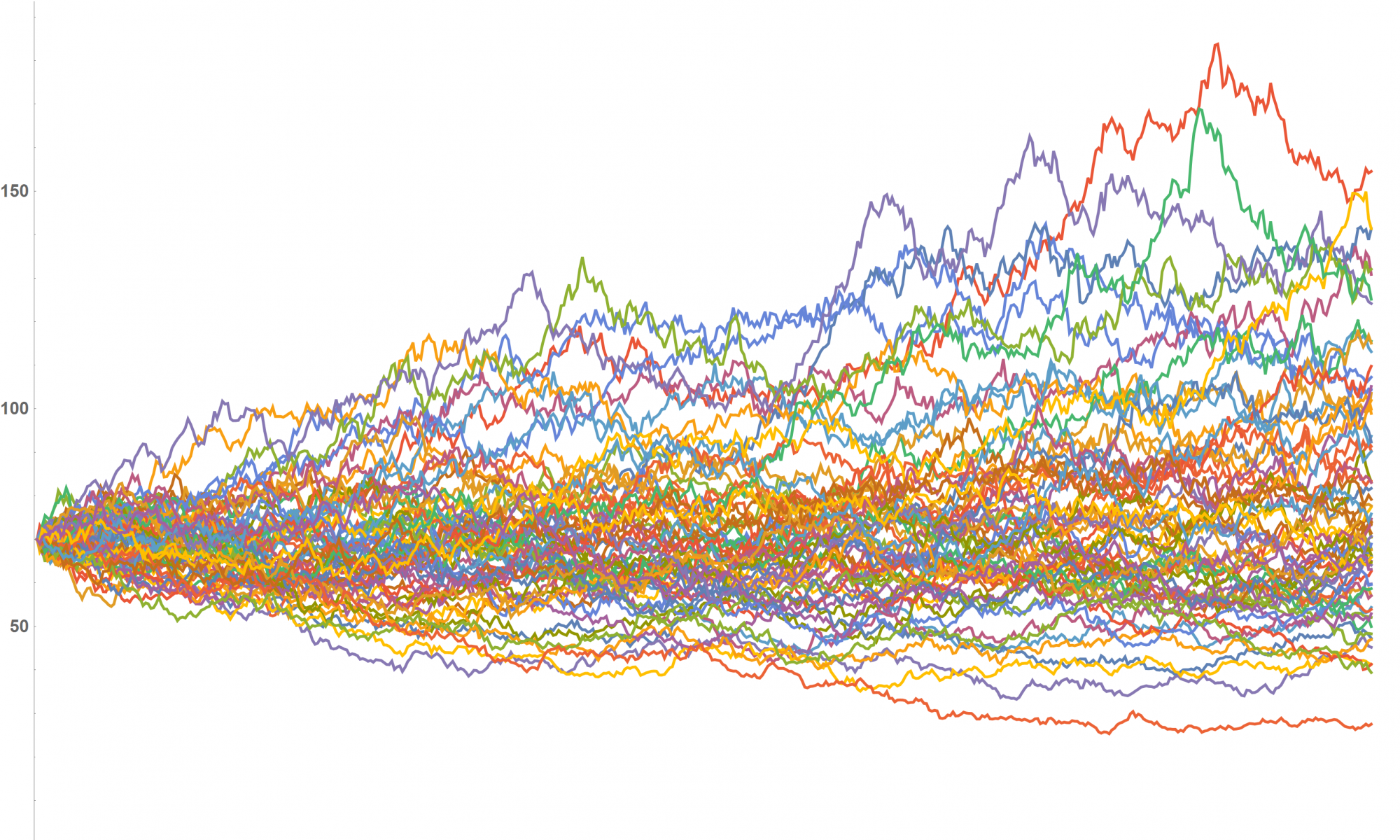

With the European Regulation 1286/2014 and the Commission Delegated Regulation 2017/653, manufacturers of packaged retail and insurance-based investment products (PRIIPs) are required to equip their PRIIPs with key information documents (KIDs) describing the risk and the possible returns of these products on not more than 3 pages.

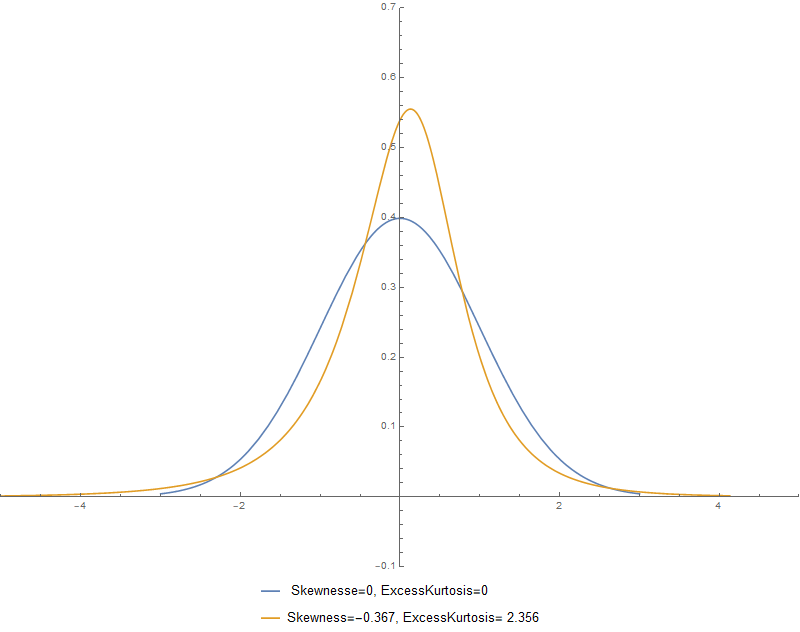

For so called category 2 instruments, the distribution of daily returns is based on their means, variance, skewness and curtosis and a Cornish-Fisher expansion. By doing so, fatter-tailed distributions are taken into account.